What you spend on groceries can be one of the most flexible line items in your budget. How do you handle budgeting for meals?

There’s no one size fits all answer to food budgeting, but there are factors, including past food expenses, current circumstances, and federal data that can help you crunch the numbers to find a very doable grocery budget. Be sure to check out How to Meal Plan on a Budget so that you can strengthen your money savings.

Estimated reading time: 7 minutes

Want to save this post?

Enter your email below and get it sent straight to your inbox. Plus, I’ll send you budget recipes and money-saving tips every week!

Jump to:

When you’re working on food budgeting, you may be wondering where in the world to start. It can be super confusing, especially if you’re reading the news headlines. (Don’t.)

Thankfully, a workable, frugal grocery budget is not out of reach. You can have your cake and pay the bills, too.

Whether you are figuring out a food budget for 2, counting the cost of groceries for a family of 4, or simply want to know how to make a monthly grocery budget, there are several factors you can consider to help you land on a reasonable monthly or weekly budget for groceries.

Why It Matters

Budgeting for meals can reel in that out-of-control feeling, like pouring water into a glass instead of all over the table. That grocery budget gives boundaries to your money, but also freedom to spend.

Food budgeting can give you more wiggle room to your overall personal budget. Since groceries are one of the most flexible line items in your monthly spending, it’s good to consider if you’re on track, if you can cut back, or if you have some flexibility to splurge. Budgeting for meals could make a big impact on your bigger financial picture.

Food budgeting is going to be dependent on a particular household’s size, income, dietary needs, and food preferences. There really isn’t a one-size-fits all answer, but there are some general factors to consider.

It’s helpful to compare notes with others, particularly those who live in the same region and/or enjoy a similar diet, so that you can see if you’re on track. But at the same time, don’t compare your apples to someone else’s oranges.

Above all, remember that food budgeting has no moral value. It is neutral. We’re talking about numbers, but it isn’t a competition.

There are no good budgets or bad budgets; simply food budgets that do or don’t work for you with the resources you have.

How to Figure it Out

Walk through these questions to get a handle on food budgeting for your household:

What are you spending now?

If you’re new to budgeting for meals, it might be hard to know where to start, especially if you’re also getting out of debt or trying to save for the first time. How much curbing is necessary?

Knowing what you spend currently will at least give you a starting place for food budgeting.

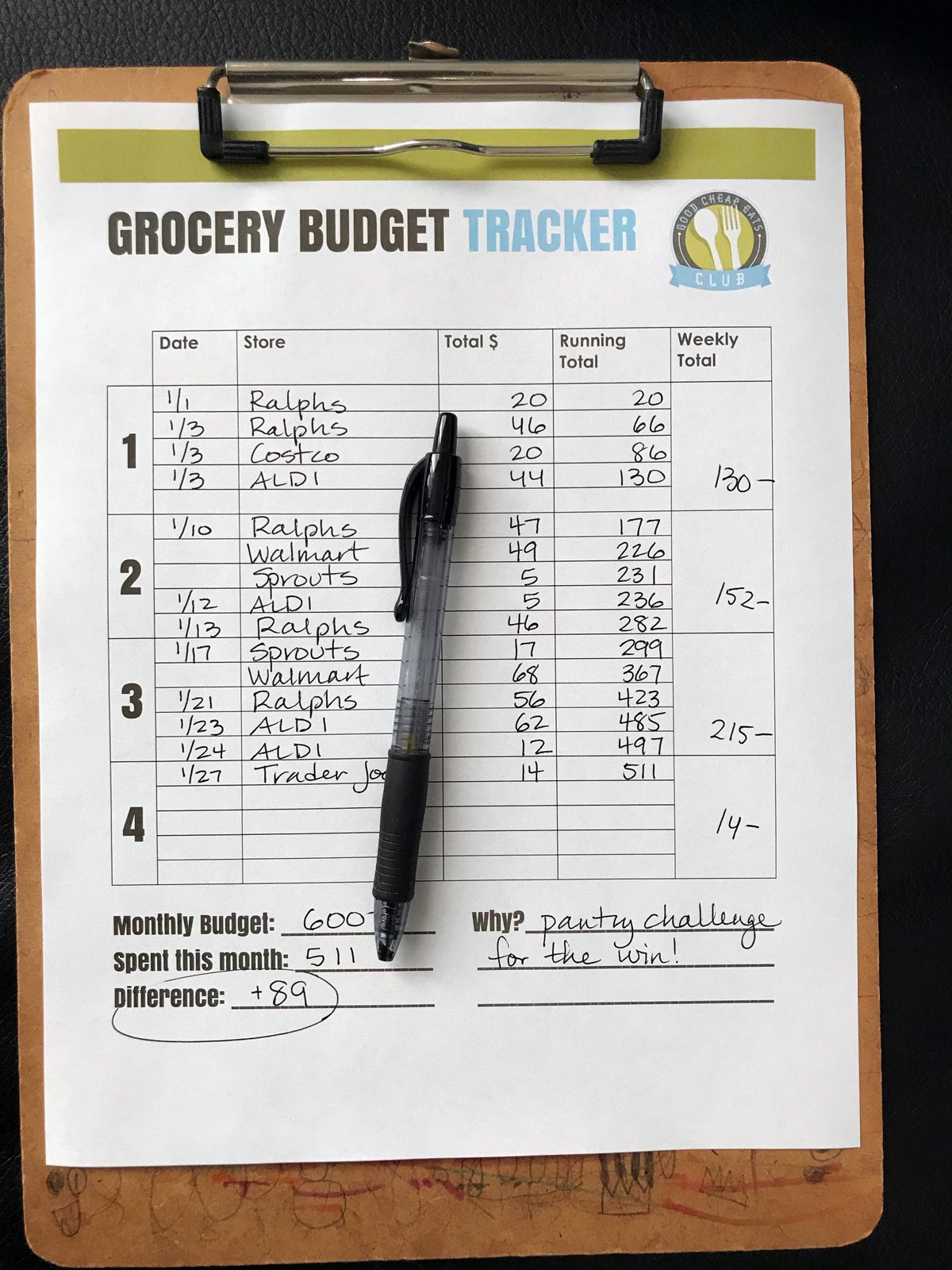

- Keep track of receipts for a month or two so you have some data to work with.

- Log into your bank or credit card account. They may already be generating reports that show this data.

- Look at what you’re spending eating out. What you spend on food away from home can be reduced by cooking at home.

Once you know what you’re spending, you’ll be able to determine if this amount can be reduced or relaxed in your food budgeting.

What can you afford?

Obviously, the money you have at your disposal will dictate your food budgeting. Once you pay for housing, utilities, and other inflexible bills, you’ve (hopefully) got discretionary funds to spend on food, clothing, etc.

To stay in the black, you may need to give up certain luxuries somewhere.

For us, we’re happy to go without cable, new cars, and fancy clothes, in order to spend money in other areas, like ample groceries, dinners out, or family travel.

Adjust your grocery budget to suit your income as well as your priorities.

What does the government say about budgeting for meals for your type of household?

Not that the government is the authority on all things grocery-related, but our tax dollars do pay for someone to track food costs nationwide. Consulting the USDA food cost reports can help you decide on your approach to budgeting for meals.

Check out the USDA Food Cost reports to see how your household adds up.

In 2022 they made some changes in how they report data. The thrifty plan data is now used to calculate SNAP benefits, while the other three plans are more reflective of research data.

I recommend using the low-cost plan to set an initial target food budget for your household.

Costs for our household of 7 in January 2024:

Female, 14-18 years = $253.60

Female, 14-18 years = $253.60

Male, 19-50 years = $298.60

Male, 19-50 years = $298.60

Male, 19-50 years = $298.60

Female, 51-70 years = $252.40

Male, 51-70 years = $281.30

Subtotal = $1936.70

minus 10% large family adjustment – 193.67

Total estimated cost on the low cost plan = $1743.03

Our target budget for 2024: $1400/month, not including dining out or household supplies/toiletries

According to the most recent report, the USDA estimates that it should cost me $1565.46 to feed my household of seven—all our meals at home along the lowest-price point—each month on the low cost plan. I know from experience that this is totally possible.

Things might get a little funky with supply chain issues, but I am confident we can swing this food budget with the Good Cheap Eats System.

How can you make all these numbers jive?

You’ve got three numbers for budgeting for meals:

- what you’re spending

- what you can afford

- what food actually costs

In a perfect world, these numbers should all match up to the ideal grocery budget. You would be budgeting for meals only what you can afford and you would be able to afford what food costs.

Unfortunately, things do not always match up.

For years Mr. Stark, a friend’s dad, prepared our taxes for free, in part because he couldn’t understand how we were able to feed everyone on how little we made.

I guess that’s the beauty of the GCE System!

Ways to Adjust

Maybe you need to make some changes in how you shop and cook so that budgeting for meals is more doable.

Auditing your grocery spending is a great place to start. Following the Good Cheap Eats System is another.

- Shop your kitchen so that you can use what you have, saving you time and money not going to the store more than you need to.

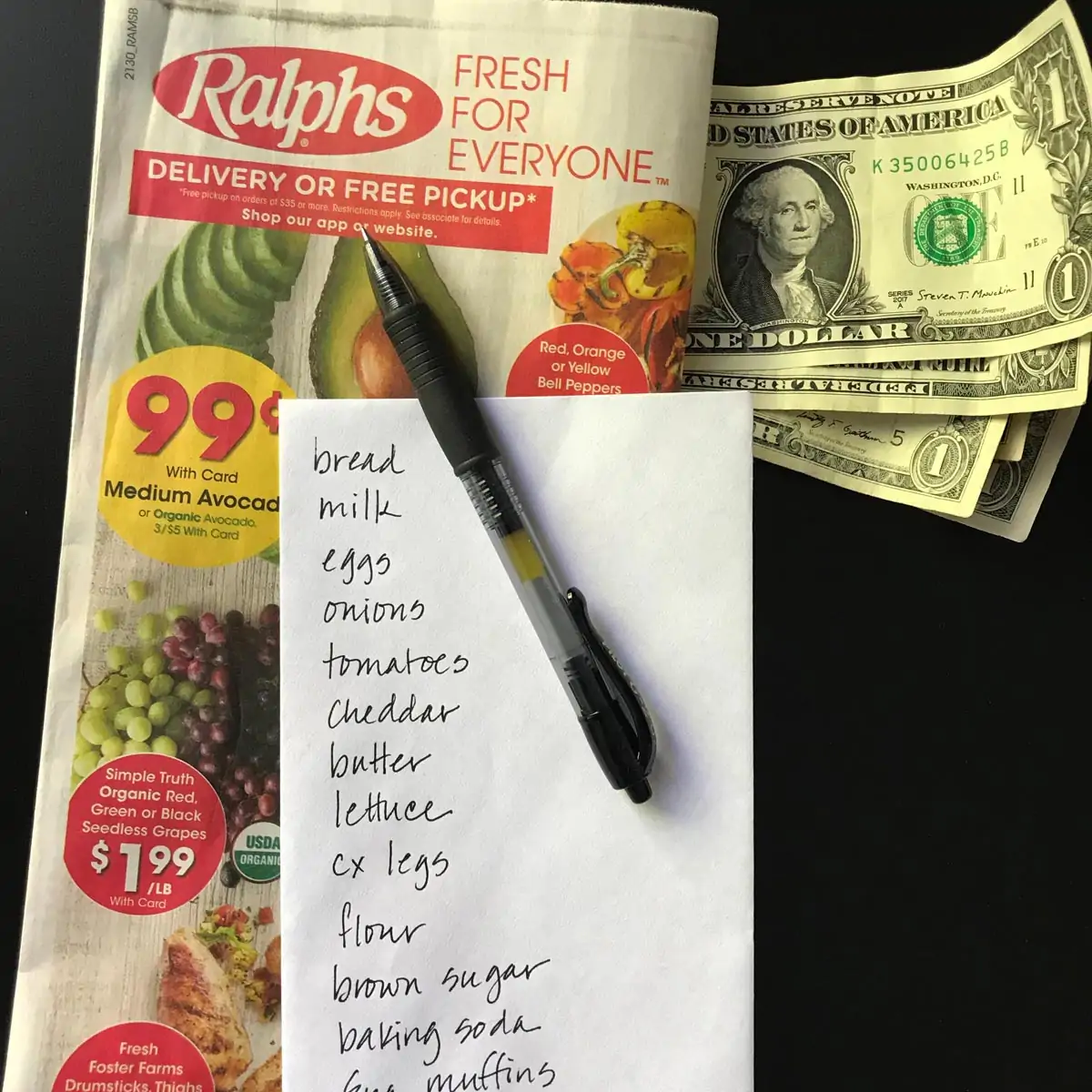

- Plan your meals to save money. This means planning meals that focus on regular low-cost ingredients, food you already have on hand, and groceries you find on sale or clearance. This Budget Grocery List is a good place to start.

- Use up leftovers. Learning how to stop wasting food can make a big difference in your overall food budget.

- Visit the store with the best prices. Where you shop matters. Many stores offer the exact same products at vastly different prices. You may be able to slash your grocery spending by shopping a different store.

- Check the sales and clearance. It’s amazing what you can find — that’s perfectly fresh! — at a discount.

- Cook from scratch. Cooking at home will almost always save you money or going out to eat.

- Freeze extra for later. Whether you’re freezing a double batch of pasta sauce or stashing away an extra pound of chicken you bought on sale, you’re buying yourself some time and saving money using your freezer.

The bottom line is that your food budgeting is going to depend on a lot of different factors, including your priorities. Gourmet coffee may be more important to you than a new pair of shoes, and that’s perfectly okay.

How do YOU decide what to spend on groceries? How are you budgeting for food?

This post was originally published July 20, 2016. It has been updated for content and clarity.

Alisha

I love Grocery Geek! Do you have any posts about what you budget for clothing and household supplies? We are getting ready to redo our monthly budget for year 2017 and your link to the USDA Food Cost page was helpful. I try to budget $600 for food but always go over, the USDA page gave the amount of $700.04 which is much closer to what I actually spend.

Jessica Fisher

Isn’t it nice to know you’re on track?

I have other budgeting resources on LifeasMom.com

DessertForTwo

I love that you mention that part of your job is recipe testing, and if it wasn’t, your bill would be lower! That’s exactly how I feel these days! And I feel guilty about it. I don’t want to know how much I spend on baking ingredients. But it’s the life I’ve chosen and it makes me happy 🙂

Love this post!

Jessica Fisher

I wouldn’t feel guilty about it, especially when you’re writing a cookbook. During my cookbook years, I did grocery geek posts very sporadically because it wasn’t real life.

Aimee Kollmansberger

Thanks for the USDA link. That was very helpful. We are a family of eight and my monthly budget is $1200 including paper products/toiletries. I thought that was high only to see that we are below the thrifty plan!! Crazy. Aldi really helps us tremendously.

Jessica Fisher

I don’t think the USDA accounts for sales, coupons, ALDI shops, etc. That chart is what food stamp amounts are based on, interestingly enough.

heather

I’m also a gardener and buy beef(450/yr) turkey ($25-40) and whole roasting chicken ($150/yr) locally in bulk. Typically we spend $80-100 and have 2 tween boys. They are giving $148/wk we have yet to even have enough money to spend that much on groceries. I have a 5 wk menu and we stock up on things that are on the menu when they are on sale.

A few years back I did a $25/wk challenge for a month, it went ok until my dad got a cow that needed to be turned into ground beef and we took home $100 worth.

Jessica Fisher

Great job feeding your family!

Katie Bee

This is such a great post!

We are now a family of 3 (yay, one flew the nest)! According to the low-cost USDA chart, we are basically at $700 a month. But of course, we’re closer to $500 simply because we buy fresh, mostly local, in-season food and stock up when we need to. I make a lot of meals or meal components ahead, which helps as well. That said, we do like to eat out a few times a week now, so we make up for the savings by enjoying a meal or two at our favorite places most weeks.

The good part is that I now know where and what I can eliminate in order to save even more when I need to, and I am very grateful for your wisdom and insight on this regularly! Thanks, Jessica!

Jessica Fisher

Great job, Katie! It’s so great when you can beat the government’s numbers. 😉

Sandi

I find it oddly interesting that if you add a single male from 19-50 range and a single female from same range, you get a thrifty rate of $350. The rate for a 2-person family comprised of a male and female in the 19-50 range is $385. Considering they could share items, I find it strange that it is a higher amount. (Sadly either one of them is significantly higher than my budget even though we both fall into that category, but we certainly have plenty to eat and we do have cable 🙂 )

Susan

Sandi,

The individual amounts are based on a family of 4. If you’ll look at the footnotes (#3) you’ll see the adjustments for other size families. The family of 2 amount that you reference has been adjusted to add 10 percent to the individual amounts. Hope this clears up your confusion!

Jessica Fisher

You excel at making a small budget work. I think a lot of it is that you and “the kid” both have great attitudes. Kudos to you for raising a good man.

Kim

Thanks for sharing!

I’ve wondered if that government guideline pertains to food only. For example, when it’s time to restock on paper towels, toilet paper and cleaning supplies, should I still expect myself to fit into whatever category is in the guidance, or do I give myself grace to go “over budget” to include those necessary items? Just curious. Thanks!

Jessica Fisher

Yes, the USDA figures are food only. So definitely adjust your numbers to account for those nonfood purchases.

Marci

I feel like its not just the amount you spend, but what you do to manage that spending that matters too.

Your pantry challenge helped me to work on a budget and do better meal planning. You also taught me to not beat myself up for going off track, splurge once in a while and when there are stress points in my life- so what- don’t stress… do take out for dinner and move on! Prior to this, I did meal planning, but didn’t have a food budget. I OVER spent all the time, wasting quite a bit of food. Im getting better.

In Hawaii, our USDA rate- latest from 2015 is $1450/month for family of 5. We spend about $1200- this includes groceries, household, cleaning, etc. We shop the weekly sales and buy meat by the bulk. I tried couponing, but was purchasing items that were not right for my family’s diet and it took me more hours than I could spare. Now I use them when its a product that I normally buy. I shop at Target and a small mom-pop grocery store in my community for most of our items. I use Amazon,Groupon and Living Social when there are amazing deals. Thanks to you Jessica- I browse through your website to find some easy recipes that we can make at home- like taco seasoning, mix/match muffins, salsa (which we LOVE) and homemade spaghetti sauce. I cook some items in bulk and freeze them for quick meals during the week and month.

thanks for the help along the way

Jessica Fisher

I’m so glad to hear how you’re progressing. GREAT job! I know Hawaii is a hard place to save, so you’re doing awesome! I’m honored to have played a small part. yay!

sylvie

I have decided to start a pantry challenge on my blog, you may want to know. I have linked to you here, I hope you don’t mind! Thanks for all you do to inspire me to do what I can!

Jessica Fisher

Good for you. I hope your challenge is going well!

Melissa M.

My grocery budget is similar to yours. I used to coupon with the best of them, but couponing has changed so much in the last few years. I coupon very little now. I do a lot of price matching at Walmart (my Walmart still does this). Last time I checked at the beginning of the year, the USDA says I should be spending $1,500/mo. for the thrifty plan for my family. If I add in the grass fed cow we buy every year, we are still coming in under that number per month. We eat almost all of our snacks & meals at home. So I’d say we’re doing fine when I compare myself against the government, but food is our largest expense outside of our mortgage. We are a family of food lovers and good food makes everyone here happy. So there’s a psychological benefit as well. I’ve been following you for years, Jessica and frankly, with all you have on your plate, I’m surprised you’re grocery bill isn’t higher. Great job!

Jessica Fisher

You can let the Walmart Savings Catcher app do the price matching for you if you have a smart phone. I haven’t saved a ton, but it’s added up over the year.

karen b

I figured ours & we are way below the thrifty plan. It says 206 a week for our family consisting of 3 males ages 45, 20, 15 & 2 females ages 47 & 18. We spend about 700 on all household expenses including tolitries, pets, paper, cleaning, etc. We do eat very well, I do some canning & freezing from our garden every year so that helps alot.

Jessica Fisher

Great job!

Sar

My situation is similar but we’re just 2 adults. I never use coupons or watch sales (unless I see something too good to pass up while I’m in store). In fact, we basically eat whatever we’re in the mood for and still fall under the thrifty category. Yahoo! What I DO do is cook breakfast, pack our lunches, and make dinner M-F. Add to that things like making my own iced coffee, pizza, etc. Food is such an easy thing to save on w/o feeling like we’re missing out!

Jessica Fisher

Great job! My guess is cooking homemade is what’s making it work. Good for you!

Jillbert

We rarely eat out and I love to cook. I make 3 homemade meals/day (and packed lunches during the school year). Because of all the cooking I do, I have no guilt about splurging on special ingredients (pine nuts, good olive oil, etc) or, my weakness, kitchen gadgets (mostly bought at the thrift store) — whatever it takes to keep the cooking fun and interesting to me. We fall in the “thrifty” meal plan arena with 3 kids (18, 15 & 13) and two adults.

Jessica Fisher

Great job!

Roberta

Looking forward to your grocery audit. I think we need one around here as well.

I’m always amazed at how well you do. Feeding your brood is a full-time job in itself! 🙂

Jessica Fisher

It does feel like it sometimes! haha!

Jodie

We are a 4 – person, 1 income household, digging out of debt. I generally have about $40-60 a week for groceries. I seriously Thank God for Aldi’s because It really allows us to buy ample food and even some decent nutritious options for a small amount of money, and I don’t have to spend hours couponing. I do like the ibotta app, as they sometimes have deals on fresh produce and dairy products. I dream of a larger food budget lol….but for now this is where we are.

Jessica Fisher

Good for you! Live like no one else… so you can live like no one else. Your scrimping and saving will pay off. Stick to your guns!

Natalie

Please tell me how you do this. We are a family of 4 and spend around $1,000 a month. I am on a NO carb lifestyle change and cant seem to spend less than $250 a week. its driving me nuts. I have an 11 (almost 12)year old girl and a 16 (almost 17) year old boy and they both eat like there is no tomorrow. I would love to be able to lower my cost of groceries. by maybe $60 a week. But since I have started this no carb lifestyle change its been really tough. I will take any and all input. no carbs mean no bread, rice, pasta, potatoes or any other carb related veggies.

PLEASE HELP!!!

Jodi

Hey Natalie! I find that finding the best prices on meat and then stocking up saves us money in the long run. For instance, I saw a ground beef sale at $2.99 lb and we eat this the most. So instead of buying what I needed for that week, I spent most of my weekly budget on that so I have it in the freezer for a lower cost during times when it is NOT on sale. Same for other proteins. I always buy more when things we eat often are on sale. That way it evens out to always spending the least amount possible for each item.

Alice E

Just an additional thought, I suspect 4 of your family eat like teenage boys, not adult men. In my experience that means they eat a good deal more than adult men especially if they are involved in sports activities. The USDA doesn’t break it down that way, but it was certainly true of my sons and nephews. Also they are growing, so the quality of the calories they get is important. Pat yourself on the back for your emphasis and healthy and nutritious food.

Jessica Fisher

Haha! Yes, that’s true!

Alice E

Nice article and full of thoughtful questions and suggestions.

We are a family of two older adults so our spending is much lower than yours. I have been tracking the last few months and we come in under the thrifty plan. Mainly by buying basics, meat and frozen vegetables on sale and eating primarily from the freezer and pantry. As a result my spending can vary widely from week to week depending on how good the sales are and whether I need what is on sale.

I never found couponing to be helpful. Primarily because the coupons were rarely for things I buy. We are buying more fresh produce in the last year or two, but we can afford it. I saves money to bake our bread, but with the heat this summer I haven’t been doing so recently.

I am amazed at how low your budget is while feeding teenage boys the quality of food you buy along with the cost of purchases for recipe development. To me it seems presumptuous for others to criticize your spending. “Should” is a bit of an arbitrary and moral word sometimes it seems to me and needs to be determined by the people doing the spending based on what money is available. We spend less than we could because I/we want the money for other purposes. That said, health and nutrition are major factors in what value we place on the groceries we buy and the time we spend preparing them. You do a very good job of getting lots of ‘bang for your buck’ with quality food and an occasional necessary treat. Thank you for the time and effort you spend sharing with us.

Jessica Fisher

Thanks for your encouragement, Alice! I think we’re all doing the best we can, aren’t we?

Katie C.

I find that checking the store flyers, knowing what I have in the freezer and THEN meal planning for the week makes a huge difference in how much I spend. I also keep items on my list that are starting to run low. If they are on sale and/or I have a coupon, I buy them, otherwise I wait a bit. It depends on the running total I keep while shopping. A lot of store are also using electronic coupons specific to the store. You should check the store’s web site.

On a funny note, I was buying dill pickles at TJ’s and ended up covered in pickle juice because one jar was cracked. They gifted me two jars. Not bad for smelling like a pickle and being a bit soggy!

Jessica Fisher

I’d take a pickle bath for that. Pickles are expensive. lol!

Megan @ Prioritized Living

I love this post!

I can absolutely relate. I used to have lots of time for hours of couponing, shopping multiple stores, and planning extensive hauls. That all changed when we bought a house, had a kid, and started a business. I spent a while sort of beating myself up because we weren’t saving as much as we used to.

You’re right that it’s all about your priorities and what kind of lifestyle you want. If spending a little more and saving a little less means more family time, more time with the hubby, and more time to relax (or sleep!), I’m more than happy with that trade-off for us.

Good for you for finding the right balance! 🙂 Your honesty is refreshing and inspiring.

CJ

Our famuly follows the USDA food budget plans. Plan is based on size of family, ages, gender and price range of plans. We do thrifty.

Jessica Fisher

Thanks for your encouragement!

Carol in CT

My gorcery budget includes only food, health and beauty aides, paper products, cleaning items. It doesn’t include any pet expenses. That said, I have a $100/person budget. We are currently a 3 person household.